As part of the sanctions against Russia, seven Russian banks have been cut off from SWIFT.

We start by discussing what SWIFT is, and then the implications of completely cutting Russia out of SWIFT.

What is SWIFT and Why Russia is Being Excluded

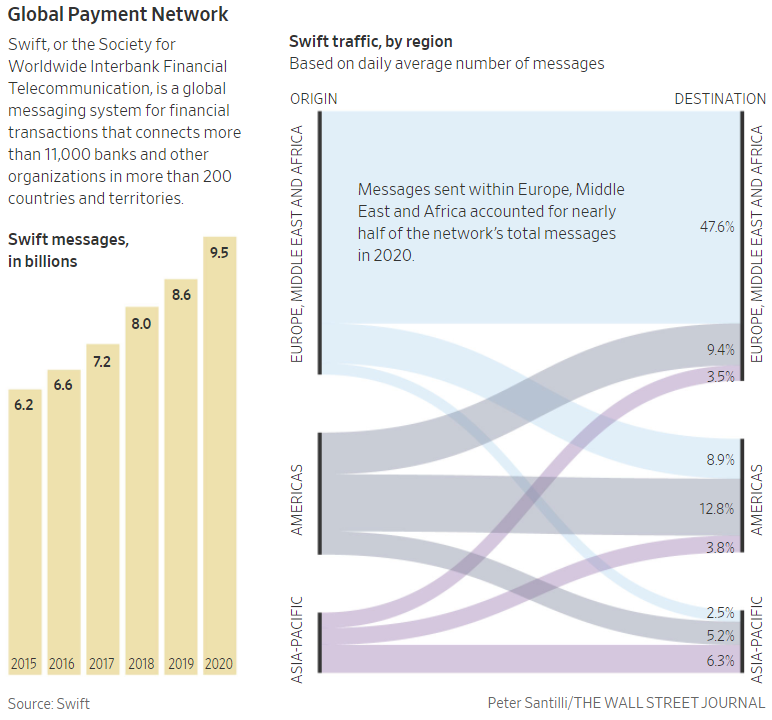

SWIFT – The Society for Worldwide Interbank Financial Telecommunication is a messaging system that links more than 11,000 banks in 200 countries.

The system doesn’t move actual money between the banks but transmits messages between banks with instructions to settle transactions.

Additionally, this system is crucial to the international trade system – without it, countries wouldn’t be able to settle trade transactions between countries.

The bar charts in the graphic from the Wall Street Journal below illustrate the growth in SWIFT messages from 6.2 billion in 2016 to 9.5 billion in 2020.

Also, the right side of the graphic shows “SWIFT traffic, by region – notably 47.6%, nearly half, of the messages sent was within Europe, the Middle East, and Africa.

The Truth About The National Debt

Watch David M Walker Only on GoldCore TV

Two key factors underlie the dilemma of cutting Russia’s access to SWIFT altogether:

- The first is how to cut the Russian banks completely off SWIFT but keep the channels open to purchase Russia’s oil and natural gas, especially in Europe, where prices have already surged over the past year.

In our January 20 post “European Energy Crisis: 4 Things You Must Know!” the 4th point was that Russia supplies ~40% of Europe’s natural gas. If this supply is no longer available prices will surge even higher!

- The second is if Russia is completely cut off of SWIFT it would be incredibly difficult for foreign banks to collect money owed to them from Russia’s banks.

According to the Bank of International Settlements Russia-based entities and banks owe foreign banks approximately $120 billion in assets, of this amount about $15 billion is owed to U.S. banks with another $25 billion of this owed to Italian and French banks.

Why SWIFT Ban is Significant for Russia?

SWIFT is the largest interbank messaging system – it benefits from the network effect, if most other banks are on the system, then banks are encouraged to join.

A large number of members reinforces and expands the network.

There are other messaging systems such as Telex, and Russia and China both have their own payment systems.

However, messaging systems such as Telex are less efficient and more expensive.

Download Your Free Guide

Russia’s own system only has 23 foreign banks connected, and China’s Cross-Border Interbank Payment System (CIPS), with around 176 participants in 47 countries is still very small in comparison to SWIFT.

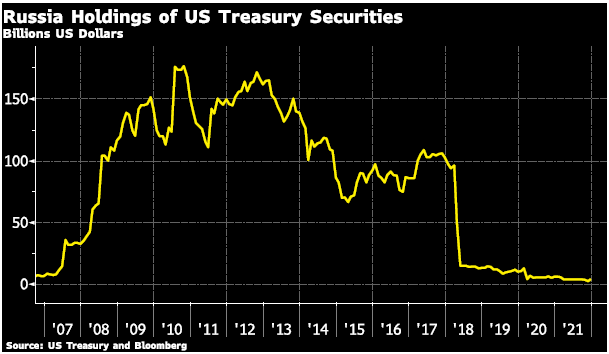

Additionally, the interconnectedness of the banking system and reliance on U.S. dollars has been an issue that Russia (and China) have been working to change.

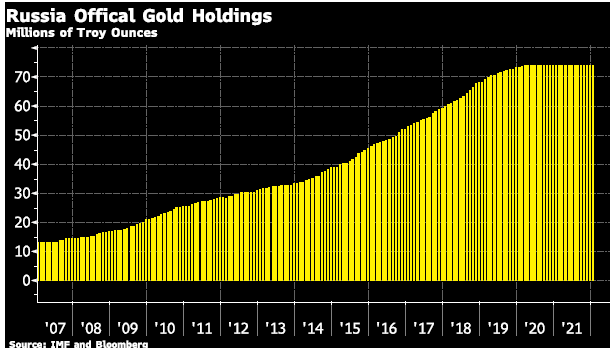

Moreover, Russia has strategically ‘de-dollarized’ its official reserves for many years.

And instead of a currency issued by another central bank, Russia has increased its official gold holdings.

Recent events have underlined the importance of your legal control of your precious metals.

That is why we offer fully allocated and fully segregated storage for your gold and silver, which we hold in bailment and not on our balance sheet.

This represents the safest form of custody for your assets

Is The Biggest Stock Market Crash Imminent?

Watch Michael Pento Only On GoldCore TV

From The Trading Desk

Market Update:

The Gold price has continued to move back and forth finding support at $1,900, within a tight range at $1,930 with the downside supported by resurfacing global economic growth concerns amid soaring energy prices.

The crisis in Ukraine has exacerbated things further, with oil and wholesale gas prices rocketing.

The USD has also strengthened as the risk aversion intensifies which in the short term could put a cap on Gold’s upside.

Fed chairman Powell met yesterday at a monetary policy hearing and confirmed the much anticipated US rate hikes would begin in March.

Powell said he will back a quarter-point rate increase when the Fed meets on the 15-16th March, with the central banking ‘carefully’ raising interest rates.

The Fed went on to say would be ready to move more aggressively, if inflation does not cool as quickly as expected which is currently the highest it has been since the 1980s.

Referring to the situation in Ukraine, he called it ‘a game changer’ that could have unpredictable consequences. “There are events yet to come and we don’t know what the real effect on the U.S. economy will be,”

Stock Update

Silver Britannia offer UK – We have just taken delivery of 10,000 Silver Britannia’s at our London depository.

Available for storage in London or immediate delivery within the UK.

These are available at the lowest premium in the market (which includes VAT at 20%). These can now be purchased online or contact our trading desk for more information.

Excellent stock and availability on all Gold Coins and bars.

Silver coins are now available for delivery or storage in Ireland and the EU with the lowest premium in the market.

Starting as low as Spot plus 32% for Silver Britannia’sSilver 100oz and 1000oz bars are also available VAT free in Zurich starting at 8% for the 1000oz bars and 12.5% for the 100oz bars.

Please see below our extended trading hours.

** We have extended our opening hours. Phone lines, online ordering and WebChat are now open until 09:00-22:00 (Europe/Dublin) USA 09:00 to 17:00 EST**

Buy Gold Coins

GOLD PRICES (USD, GBP & EUR – AM/ PM LBMA Fix)

02-03-2022 1926.00 1928.50 1447.00 1445.60 1736.48 1738.16

01-03-2022 1920.45 1922.00 1434.00 1435.54 1719.57 1724.23

28-02-2022 1903.30 1909.85 1421.19 1424.18 1700.60 1701.29

25-02-2022 1912.15 1884.80 1429.33 1408.70 1711.57 1677.66

24-02-2022 1968.35 1936.30 1466.22 1453.39 1760.49 1737.25

23-02-2022 1895.70 1904.70 1392.77 1403.19 1669.54 1680.52

22-02-2022 1895.00 1900.10 1395.29 1402.27 1671.20 1674.75

21-02-2022 1895.45 1894.45 1390.88 1392.04 1668.38 1671.47

18-02-2022 1886.95 1893.60 1386.15 1391.99 1660.14 1669.21

17-02-2022 1886.55 1893.45 1386.24 1389.98 1659.79 1665.48

Buy gold coins and bars and store them in the safest vaults in Switzerland, London or Singapore with GoldCore.

Learn why Switzerland remains a safe-haven jurisdiction for owning precious metals. Access Our Most Popular Guide, the Essential Guide to Storing Gold in Switzerland here

Receive Our Award Winning Market Updates In Your Inbox – Sign Up Here