Russia: A Prominent Player in the Global Gold Market?

Geopolitical tensions between Russia and the US are heating up again. The WSJ (12/07) reported:

“President Biden warned Russian President Vladimir Putin that the U.S. and its allies would meet a military invasion of Ukraine with strong economic penalties, moves to bolster Ukrainian defenses and fortify support for Eastern European nations.”

This comes days after the Russian Finance minister announced that they planned to add US$6.7 billion to its gold and foreign exchange reserves over the next month.

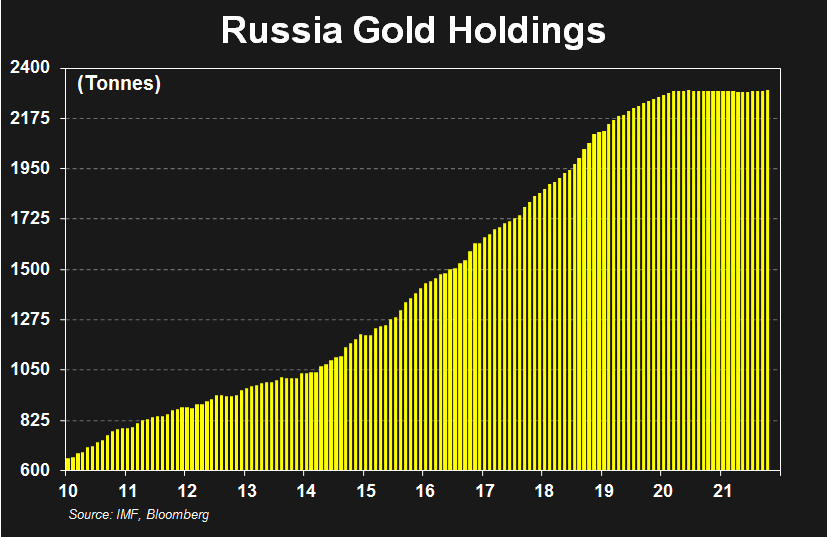

Prior to putting gold purchases on hold at the beginning of 2020 due to a slump in oil prices, the Covid-19 pandemic, and other geopolitical risks, Russia had added an average of 205 tonnes of gold to its official holdings since 2015.

Also, at 2,302 tonnes, Russia has the 5th largest gold holdings behind the US, Germany, Italy, and France.

US and EU Put Sweeping Sanctions on Russia

The increase in Russia’s gold reserves is part of a multi-year drive to reduce the countries exposure to US dollars and the Euro.

Nevertheless, this campaign began in earnest after the US put sweeping sanctions on Russia in 2014. This was in response to Russia’s backing of separatist groups in eastern Ukraine.

Additionally, these sanctions targeted major sectors of the Russian economy including the finance, oil, and weapons sectors.

Three of the country’s largest state-owned banks were cut off from the US economy.

The United States and European Union also denied Russian banks access to the European capital markets. It also banned any arms or related imports or exports. Also, denied the country technology and equipment related to the energy sector.

China’s Digital Currency: A Warning to the World Part 1

Watch Dr. Stephen Leeb Only on GoldCoreTV

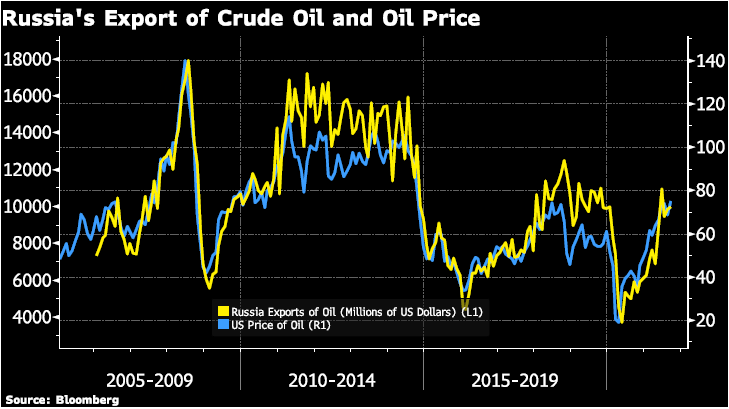

Prior to the 2014 sanctions and the ensuing de-dollarization plan, Russia had amassed large US dollar reserves. This was due to the large exports of oil and gas. These are priced in US dollars.

Also, the oil and gas sector accounts for approximately 60% of Russia’s exports. This comprises about 30% of the country’s GDP.

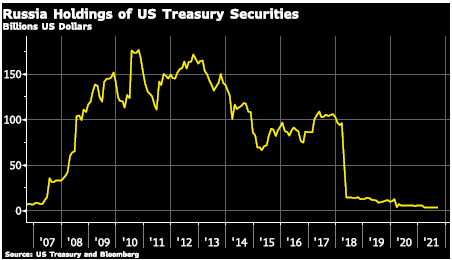

According to the US Treasury Foreign Holding Statement, Russia’s holdings of US Treasuries peaked at US$176 billion in October 2010.

It also averaged over US$150 billion until close to the end of 2013.

This was prior to declining to just under US$100 billion by early 2018.

A further steep decline occurred in 2018 as the US issued additional sanctions against Russia.

This resulted in the country doubling down on its efforts to ‘wean’ the county off the US dollar.

Download Your Free Guide

Specifically, the Trump administration issued additional sanctions against seven Russian oligarchs with ties to Putin and 12 companies they owned.

The sanctions were also aimed at 17 senior Russian government officials and the state-owned weapons company.

However, the US claimed the sanctions were in response to Russia’s interference in the 2016 US election. Also the ongoing threats against Syria, Ukraine, and Crimea.

Russia to Increase its Gold Reserves

In July 2018, the president of the second-largest bank submitted a plan to move the country further away from the US currency:

“Russia has been seeking ways of decreasing its dependence on the US currency after Washington and its allies imposed sanctions against the country in 2014.

In May, President Putin said Russia can no longer trust the US dollar-dominated financial system.

This is because America is imposing unilateral sanctions and violating World Trade Organization (WTO) rules.

Putin added that the dollar monopoly is unsafe and dangerous for the global economy.” (RT.com, 10/18).

Russia’s oil revenues shown in US dollars on the chart above are, as one might expect tied to the price of oil.

According to its revised oil strategy plan released in April by the Energy Ministry stated that the country’s focus will be on maximizing its crude exports before reaching peak production in 2027-2029.

Additionally, world demand is expected to decline due to the increased emphasis on renewable energy and global decarbonization trends.

The bottom line is that for the coming years Russia will continue to want to diversify the monetization of its energy production into holdings that do not involve American, or European or any other countries rules which looking at pre-covid data would put Russia’s gold demand at over 200 tonnes per year for the next six to eight years.

China’s Digital Currency: A warning to the World Part 2

Watch Dr. Stephen Leeb Only on GoldCore TV

From The Trading Desk

Market Update

Gold has continued this week in a tight trading range between $1770 to $1790.

The market is waiting for more direction from the Federal Reserve who meet next week (14th -15th December).

There is increased expectation that policymakers at this meeting will discuss accelerating the timetable for the tapering of monthly bond purchases by more than the $15 billion per month with Powell recently saying tapering could wrap up a ‘few months sooner than anticipated.

We should also get an update on projections for interest rate hikes for 2022. Since the Fed tries to get a handle on inflation, with two quarter-point increases priced in for next year.

Meanwhile, the central banks globally continue to add to their Gold reserves.

The central bank of Singapore increased its Gold Reserves for the first time in 20 years. Increasing its reserves by 20% (26.35 tons), bringing its total to 153.76 tons.

The Royal Bank of India too has added 71 tonnes to its reserve this year, bringing its total to 748 tons.

The Irish central bank also added to its reserves for the first time since 2009 adding 2 metric tons.

We are seeing the same from the central banks of Poland, Turkey, Russia, etc too

This is due to high debt in every major economy, the central banks of these nations are not able to raise interest rates.

Lower nominal rates along with rising inflation is creating buoyancy in precious metals markets as investors are more willing to invest in gold and silver than in advanced nations bonds that are yielding negative or insignificant rates.

Stock Update

Gold Offer Zurich –

We have a very limited number of Gold 1kg Bars for Storage in Zurich at spot plus 1.25%. Please contact our trading desk to avail of this offer.

Excellent stock and availability on all gold coins and bars with 1oz bars at a very competitive 3.75% over spot. Gold Britannia’s starting at 5% over Spot.

Silver coins are now available for delivery or storage in Ireland and the EU with the lowest premium in the market.

Starting as low as Spot plus 32% for Silver Britannia’s.

Silver Britannia’s for UK delivery or storage are still available at the lowest premium in the market (which includes VAT at 20%). These can now be purchased online.

Silver 100oz and 1000oz bars are also available VAT-free in Zurich starting at 8% for the 1000oz bars and 12.5% for the 100oz bars.

Please see below our extended trading hours.

** We have extended our opening hours. Phone lines, online ordering and WebChat are now open until 09:00-22:00 (Europe/Dublin) USA 09:00 to 17:00 EST**

Buy Gold Coins

GOLD PRICES (USD, GBP & EUR – AM/ PM LBMA Fix)

08-12-2021 1789.80 1783.80 1354.52 1351.05 1585.76 1577.59

07-12-2021 1779.65 1781.35 1342.21 1346.17 1579.08 1584.69

06-12-2021 1781.25 1778.65 1343.60 1343.24 1575.16 1575.71

03-12-2021 1773.50 1767.55 1335.27 1335.38 1568.48 1566.93

02-12-2021 1775.70 1765.00 1333.91 1325.52 1567.41 1556.91

01-12-2021 1786.80 1789.25 1341.89 1340.69 1577.74 1576.51

30-11-2021 1797.60 1804.40 1345.32 1350.59 1582.25 1587.33

29-11-2021 1795.00 1785.95 1344.99 1343.21 1589.83 1585.92

26-11-2021 1809.80 1800.80 1358.44 1350.78 1604.75 1594.97

25-11-2021 1790.65 1788.15 1343.88 1343.44 1595.83 1594.31

Buy gold coins and bars and store them in the safest vaults in Switzerland, London or Singapore with GoldCore.

Learn why Switzerland remains a safe-haven jurisdiction for owning precious metals. Access Our Most Popular Guide, the Essential Guide to Storing Gold in Switzerland here

Receive Our Award Winning Market Updates In Your Inbox – Sign Up Here