Each year professional analysts and forecasters shine up their crystal balls to submit their precious metal price forecasts to the LBMA. The contest is to be the most accurate predictor for the gold price average for the year; the analyst with the closest average price for the year wins a 1oz. gold bar. The 2023 forecasts, which analysts submitted in mid-January, were published on February 27.

The forecasts always draw a wide range of possible outcomes and 2023 is no different with the lowest annual average forecast for the gold price at US$1,594 and the highest at US$2,025; the average of all analysts coming in at $1,859.90, which is 3.3% above the average set in 2022 of US$1,800.09.

The outlook for silver is somewhat more optimistic. The low average price forecast submitted was US$17.50, the high was US$27 and the average of all analysts came in at US$23.65, which is 8.8% higher than the actual average for 2022 of US$21.73.

Along with the forecasts, each analyst must also provide the top reasons behind their forecasts. The overall top three drivers for gold were: the US dollar and the related Fed Monetary Policy, followed by inflation, and finally geopolitical Factors.

Download Your Free Guide

The analyst that submitted the lowest gold price average for the year cited rising real interest rates for the decline of the gold price in 2023. However, he does note that gold will start rallying once the next interest rate easing cycle can be priced in.

The analyst with the highest gold price thinks that the US economy will turn weaker soon and the US dollar will start to decline turning the investment environment towards gold’s favour.

These two forecasts bracket the entire spectrum of conventional wisdom. Neither of them is a groundbreaking idea.

Regarding silver, analysts cite many of the same reasons as gold for their forecasts, but the lowest price forecast comes from an analyst expecting ‘lackluster industrial demand growth” as a headwind for silver.

But he then adds that this will also turn more positive in the medium-term. On the high end of the price forecasts analysts look for support for the ‘clean technology movement’ in the way of increased demand for solar panels and electric vehicles to boost silver demand.

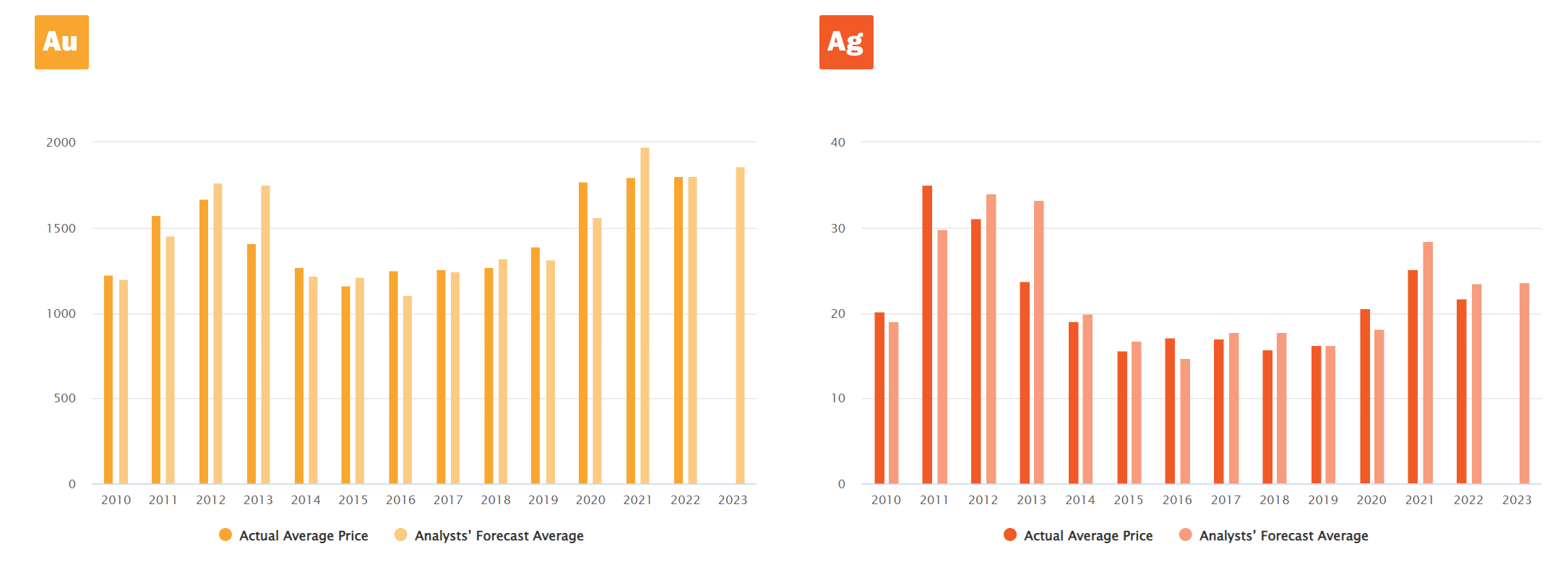

A look back at previous forecasts

Analysts’ forecasts summited at the beginning of 2022 calculated an average price that was US$1,801.90 and the actual price came in at $1,800.09 – only US$1 off – which is an amazing result. Analysts were too optimistic on silver however, with an average analyst expectation of US$23.54 in 2022, and the actual average coming in at $21.73.

The chart below, from the LBMA’s website, shows the actual average and analysts’ average over the last 12 years.

Two important things should be pointed out from these charts. First, is that when averaged together, expert analysts’ predictions are generally not ‘too far’ off from the actual average. This makes sense because physical metals prices do move around over time but are not completely unpredictable nor particularly volatile.

Second, is that professional forecasters, even when using the average of a bunch of forecasts, tend to lag the price by one to two years – meaning that they are slow to see the turns in the market. Said another way, the expert opinion and conventional wisdom unconsciously assume that whatever happened over the past 24 months is likely to continue for the next 12 months.

Do gold and silver price predictions matter?

Price predictions are just predictions. The analysts who make them do not really have a crystal ball, but they do have experience of precious metals markets and the factors that affect them. They are interesting from an investor’s point of view as they give insight into what major players in the gold and silver market are looking out for, what they are anxious about and how confident they are feeling about the next 12 months.

But, really how much predictions matter just comes down to whether or not prices matter. We are often asked ‘is now a good time to buy gold?’ and the question comes from a concern about missing out on a ‘good price’. In truth, if your decision is to buy now or next month, then there is unlikely to be much in it and you might be looking at gold from the wrong perspective.

Why Gareth Soloway is “unbelievably bullish” on gold and silver

People invest in gold not primarily to make a profit from year to year but because they see it as a way of holding insurance for their portfolio. The gold (and silver) is there to protect the value of your portfolio, rather than make a quick buck month to month.

Purchasing gold is similar to purchasing insurance. We don’t consider if it’s a good time to purchase home insurance when we make the purchase, because we are aware that we wish to protect our homes with insurance in the event of any unforeseeable circumstances.

We also never question ourselves when going without insurance would be a smart idea. The same is true with gold. When is a good time to be without gold is a better question to ask than when gold is a good price.

Read more about if it’s a good time to buy gold.

From The Trading Desk

Market Update-

Euro Zone inflation numbers are still running hot and not coming down as quickly as the ECB would like.

In fact the numbers out of France and Spain earlier in the week, French consumer prices rose to 7.2% in the year to February, which is the highest since the euro was established in 1999.

Spanish inflation numbers jumped to 6.1% from 5.9% running way hotter than expectations at 5.5%.

Headline inflation across the 20 member bloc released earlier this morning, came in at 8.5% for February, cooling from a high of 10.6. However, inflation is not coming down quick enough to the ECB target of 2%.

The market is now firmly pricing in a 50bp rate hike at the next ECB meeting on March 16th and like the US, rates look like they are going to have to stay higher for longer.

The gold price has continued to trade in a tight trading range, getting close to the psychological $1,800 level earlier in the week before a bounce moving back above $1,830 as the recent dollar strength paused.

Stock Update

Silver Britannia’s– We have a limited number of Silver Britannia’s from the Royal Mint, with the lowest premium in the market atsSpot plus 38% for EU storage and delivery and spot plus 35% for UK storage and delivery. Please call our trading desk to avail of this offer. Stock is limited at this reduced premium.

Gold Britannia’s are available again for UK storage and delivery starting at 4% over Spot and Gold 1oz Bars start at 4.2% over Spot.

GoldCore have excellent stock and availability on all gold coins and bars. Please contact our trading desk with any questions you may have.

Buy Gold Coins

GOLD PRICES (USD, GBP & EUR – AM/ PM LBMA Fix)

01-03-2023 1833.50 1841.25 1521.81 1532.84 1720.19 1725.80

28-02-2023 1810.20 1824.60 1498.66 1502.92 1705.93 1714.94

27-02-2023 1809.05 1818.65 1512.00 1512.75 1714.26 1717.35

24-02-2023 1824.10 1810.95 1517.29 1516.13 1722.13 1717.87

23-02-2023 1826.95 1826.05 1518.01 1515.07 1724.64 1721.97

22-02-2023 1833.45 1835.75 1518.46 1516.33 1723.63 1723.03

21-02-2023 1833.20 1836.85 1516.42 1519.26 1719.91 1723.70

20-02-2023 1844.20 1845.80 1533.27 1532.94 1725.99 1726.19

17-02-2023 1824.50 1833.95 1527.65 1527.50 1714.85 1719.69

16-02-2023 1837.30 1828.95 1522.94 1526.62 1715.67 1715.37

Buy gold coins and bars and store them in the safest vaults in Switzerland, London or Singapore with GoldCore.

Learn why Switzerland remains a safe-haven jurisdiction for owning precious metals. Access Our Most Popular Guide, the Essential Guide to Storing Gold in Switzerland here

Receive Our Award Winning Market Updates In Your Inbox – Sign Up Here